The survival of the paranoid

Economic & political volatility is rising as a new global regime emerges. Firms & governments need to position for sustained turbulence.

The global economy is being buffeted by shocks: from a surge in inflation and higher interest rates, to global supply chain disruptions and geopolitical conflict. Volatility in global equity markets remains elevated, reflecting substantial economic and political uncertainty. JP Morgan’s Jamie Dimon this week warned investors to brace for an economic hurricane.

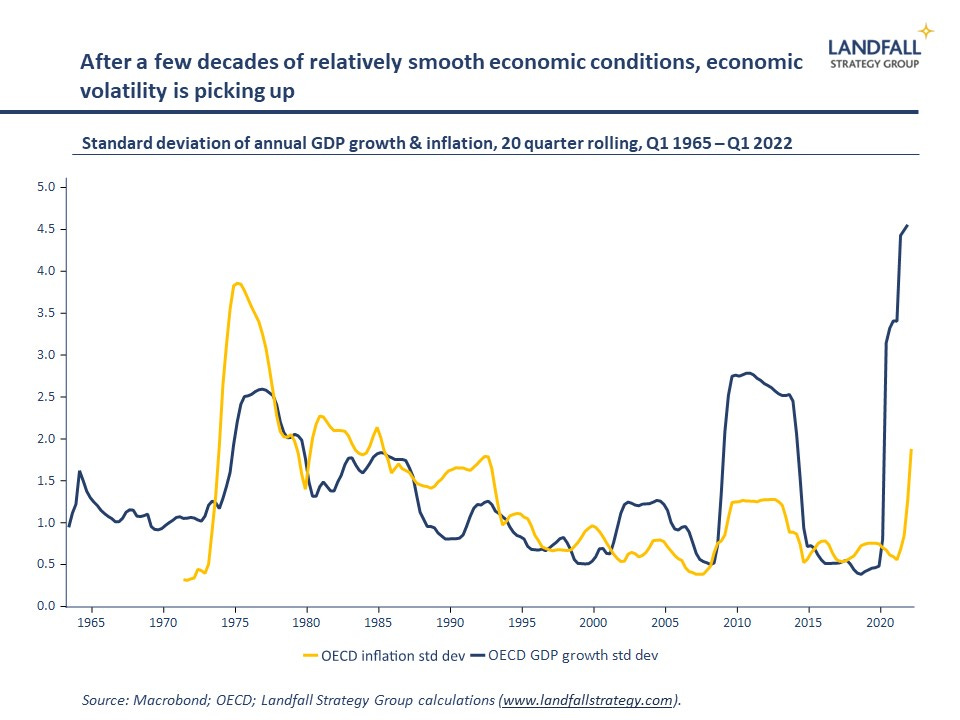

Some of this is the consequence of emerging from a global pandemic, as well as the near-term impact of Russia’s invasion of Ukraine. In addition, structural dynamics – from regime change in geopolitics and globalisation to the net zero transition and disruptive technologies – are leading to sustained high levels of economic volatility.

Despite being punctuated by the pandemic and the global financial crisis, the past 30 years have been a period of reasonable calm in the global business cycle. This Great Moderation is behind us, and sustained turbulence is likely as we transition to a new economic and political regime.

Great Mod…