Summer's over

On the fifth anniversary of these notes, global economic and geopolitical regime change continues to accelerate

I have been writing these notes on substack for five years this month, after deciding to restart writing regular public notes in the depths of the pandemic. It was good timing. The past five years have been particularly turbulent and consequential: Covid; the second Russian invasion of Ukraine; strategic rivalry between the US and China; the rewiring of global flows; and now the second Trump Administration. A process of economic and geopolitical regime change is underway. And it’s likely that the next five years will be at least as disruptive.

This note discusses seven recent global economic and geopolitical developments that provide insight into how this new world is shaping up. Do get in touch if you would like to discuss. I’m at david.skilling@landfallstrategy.com or on LinkedIn.

And all the best to my Northern Hemisphere readers as we transition from summer into a busy back half of the year.

1. US exceptionalism redux?

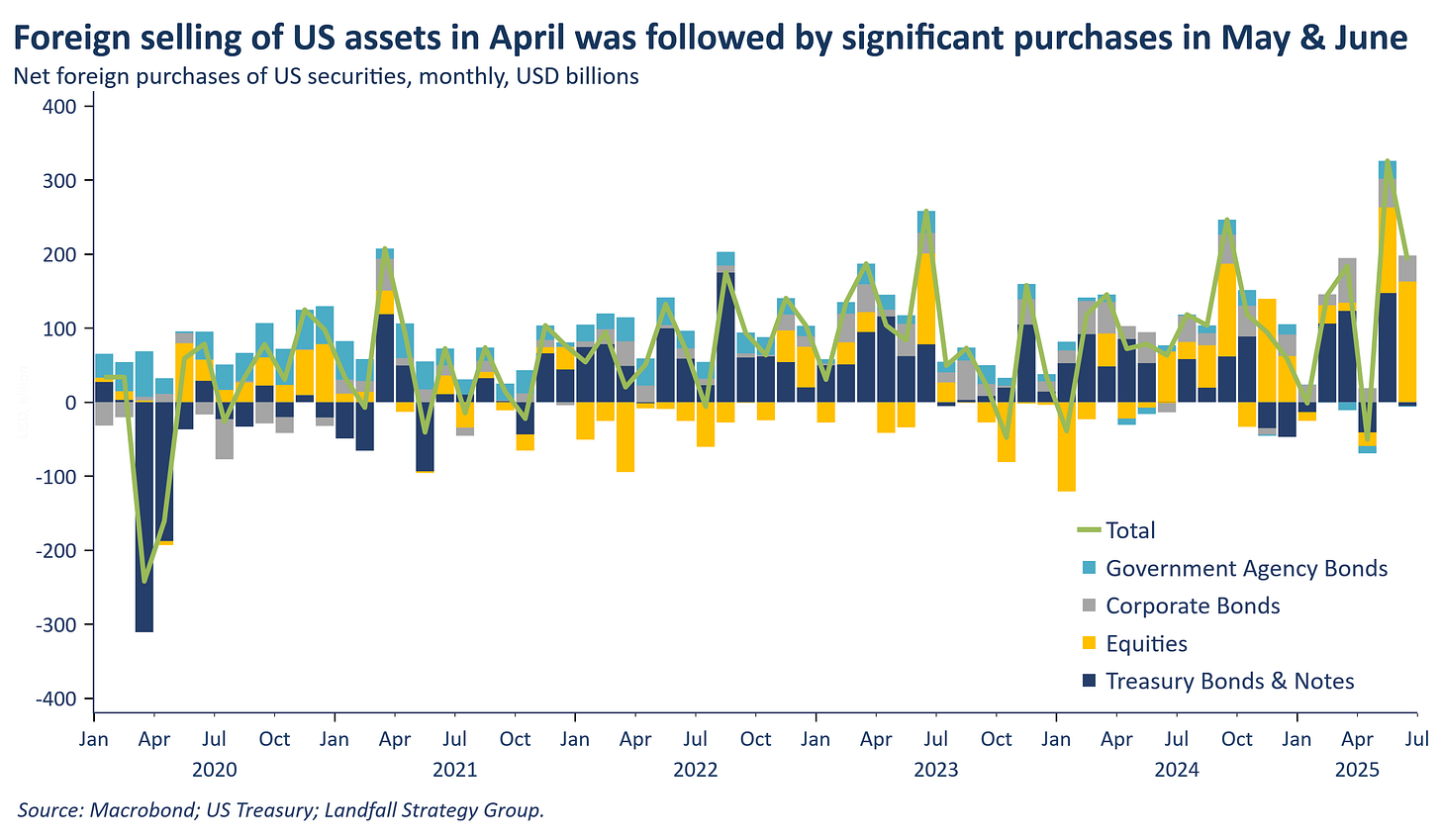

The current US tariff rate is estimated at 18%, not far below Liberation Day levels. Immediately after the shock of the Liberation Day announcements in April, US markets sold off heavily and foreign investors withdrew capital from US equity and bond markets. But almost five months on, US equity markets are at record levels and foreign investors have returned. Treasury data for May and June show that foreign investors have since allocated substantial amounts into US equities, although flows into US Treasuries are not as strong. This foreign investor capital allocation has been supported by the recovery in US equity markets, particularly in the tech sector. So was this simply a very brief interruption to US economic/market exceptionalism? I am not so sure: my sense is that the relative risk/return profile of the US compared to other markets has structurally shifted.

2. Green transition

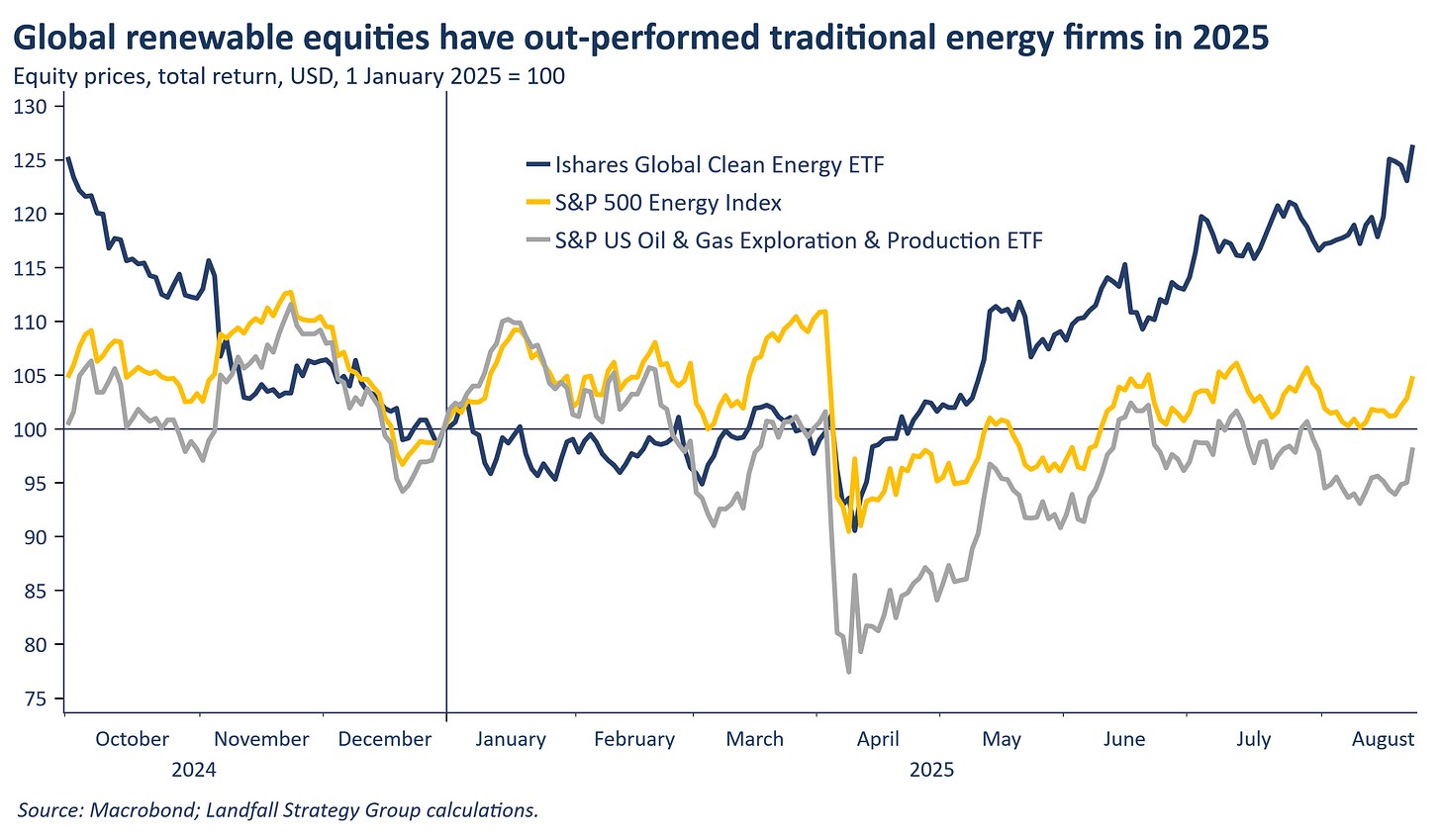

The political mood music around climate and sustainability policy has changed over the past year. In the EU, green policy has been de-emphasised in favour of competitiveness and security (partly in response to a voter backlash). And the Trump Administration is openly hostile to renewables, particularly wind, reversing various subsidies and policy/regulatory support measures – and favouring oil and gas. But the economics of renewables continue to improve materially and global installations continue to grow. And this European summer was another ominous reminder of the realities of climate change. It is striking that a benchmark global clean energy ETF is up by ~10% year to date in euro terms (and ~26% in USD terms), well ahead of traditional energy ETFs (oil prices remain subdued for both supply and demand reasons). And the share prices of Chinese EV manufacturers and battery companies (such as BYD, CATL) have also surged. The policy environment may be more challenging, and there are numerous headwinds, but markets are pricing upside for beaten-down renewables firms.

3. Swiss safe haven

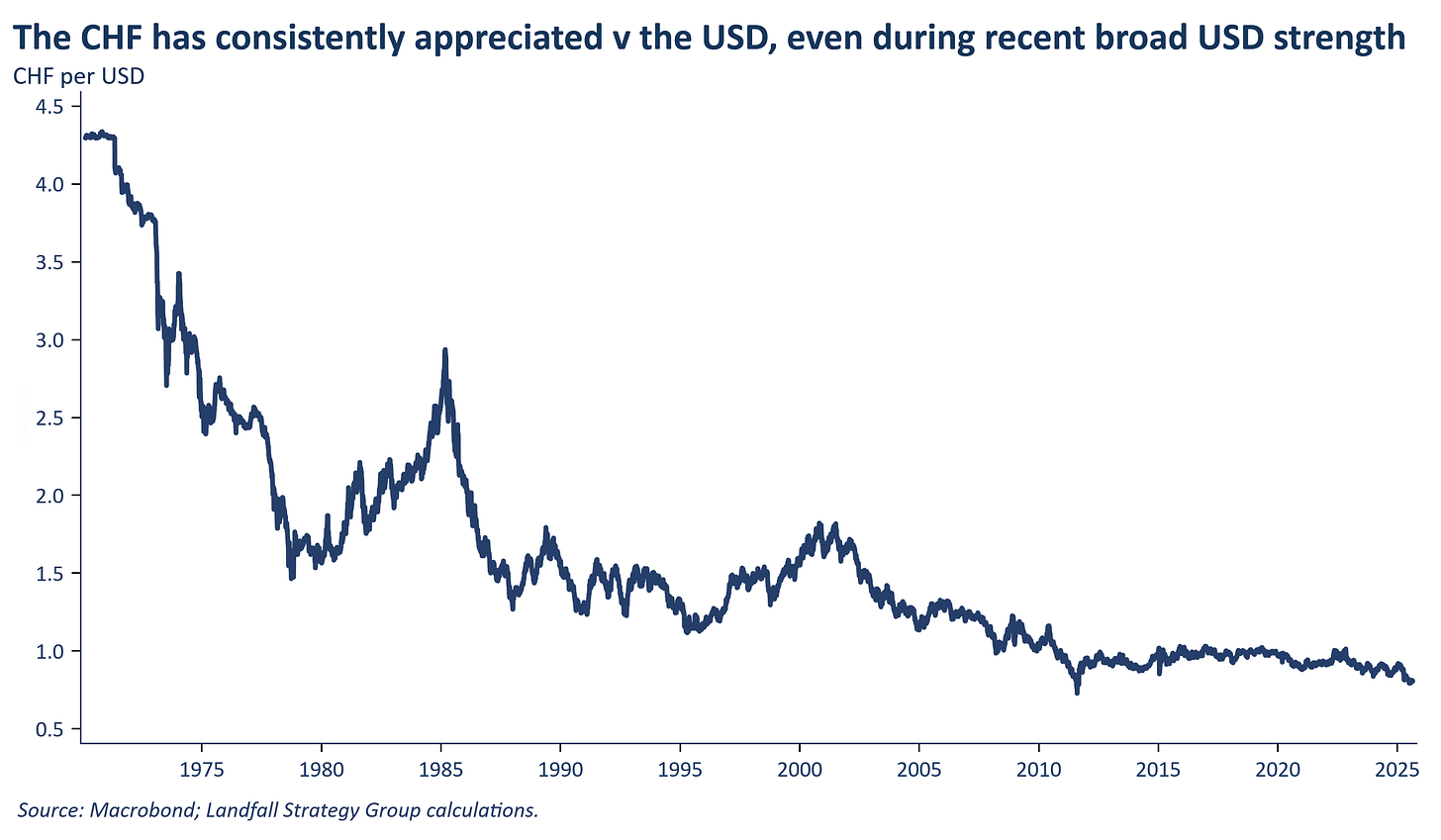

It is difficult to imagine two models of governance that are more different than the Trump Administration and the Swiss federal system. The collision between the two political systems (as well as an unfortunately high Swiss trade surplus with the US in 2024, supported by strong gold exports) has led to a US tariff rate of 39%, one of the highest rates in the world. The Swiss are now scrambling to find a way out, from proposals to enlist the FIFA President to offers to host Mr Putin for peace talks. These tariffs will impose costs on the Swiss economy, one of the most US-exposed trading economies in Europe (notably pharma). But Switzerland is still a safe haven: the CHF remains strong and Swiss government bond yields are negative out to 3-year terms. Over the past century and more of economic, financial, and geopolitical shocks, the Swiss economy has been resilient and the CHF has been a reliable store of value. My assessment is that this will continue: Switzerland’s strong economic policy settings will be increasingly valued, despite near-term headwinds.

4. Mr Modi goes to Beijing

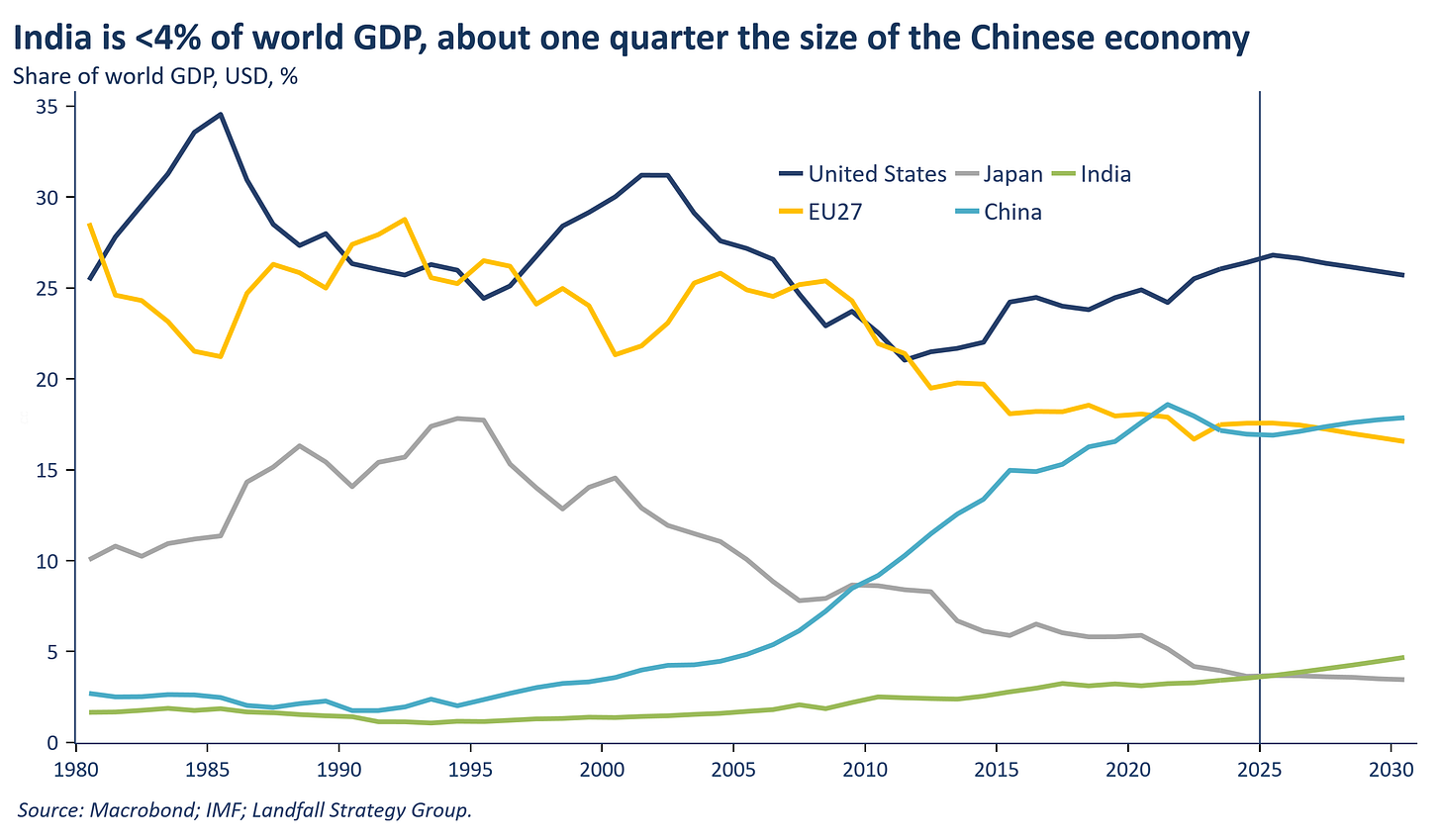

Mr Modi is visiting China from next Sunday, part of a new commitment to strengthen relations with China. This is partly motivated by the unexpectedly tough US tariffs on India, currently 50%. Mr Modi had good relations with Mr Trump during the first term, but things have changed under the mercurial approach to foreign policy of the second Trump Administration: Mr Trump recently referred to the Indian economy as ‘dead’. The India/China relationship has been fraught for many reasons, but India needs options given these strategic challenges. But it is a lopsided economic relationship: India imports almost 20% of its goods from China but ~3% of India’s exports of goods go to China; and India is not a meaningful competitor to China in terms of manufacturing. And although India is the largest economy by population in the world, it is <4% of global GDP in USD terms. This relative absence of global economic heft is a challenge for India in pursuing its multi-aligned foreign policy stance in a global context of full spectrum strategic competition.

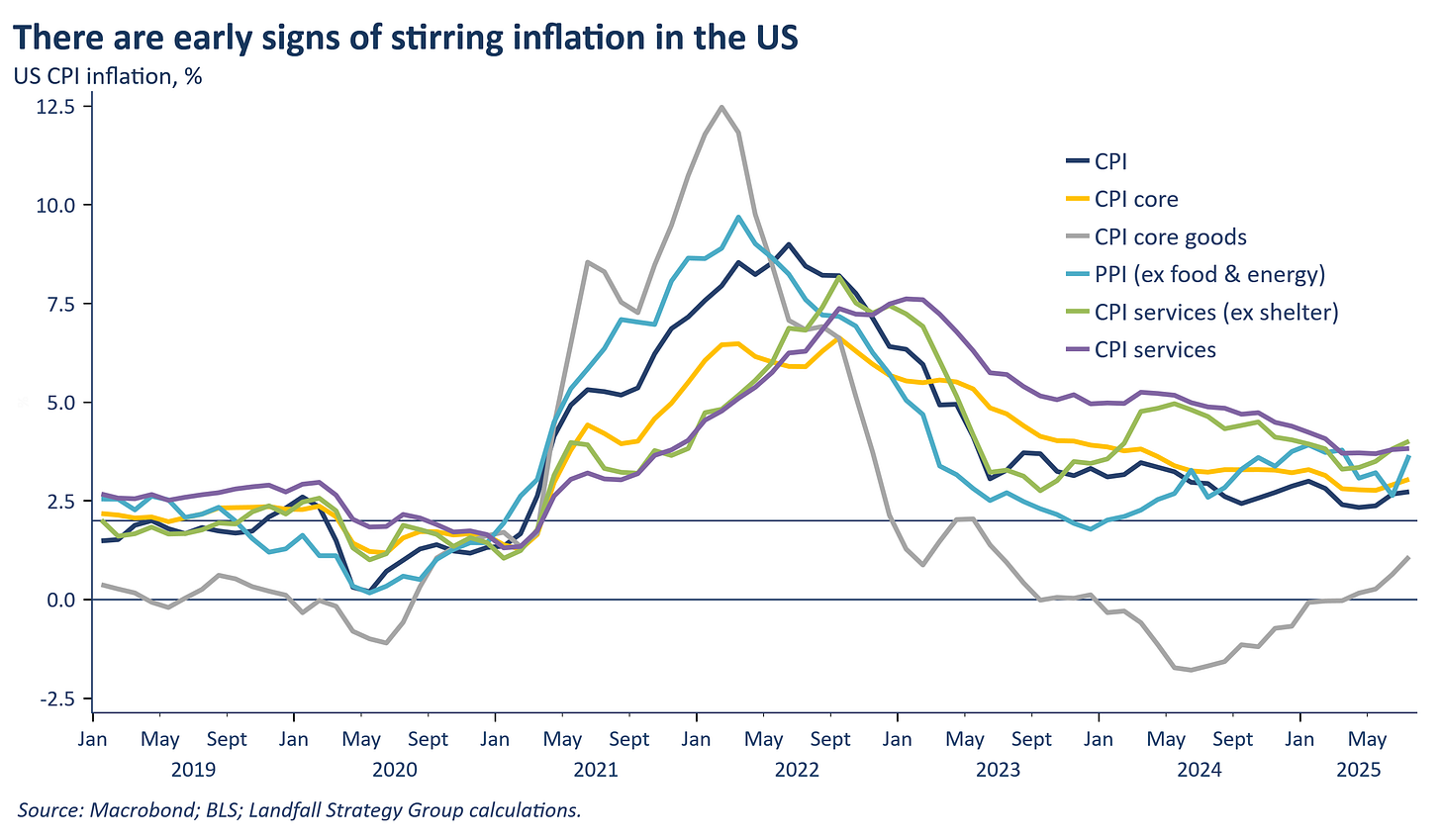

5. Stagflation

Jerome Powell’s speech at the Jackson Hole meetings on Friday was received positively by markets, with equity and bond markets rallying (and the USD falling) on its dovish tone. The US economy is softening, albeit from strong growth rates. But inflationary pressures are picking up across the economy: from the early impact of tariffs, to constraints on labour supply, a lower USD, fiscal stimulus, and more. Goods inflation is picking up, and there are risks to services inflation as well. Of course, policy arguments can be made in both directions: stagflationary dynamics are difficult for central banks to manage and there is much uncertainty. But my sense is that inflationary pressures are likely to build over the coming months: the Fed will have to deal with these economic pressures as well as the substantial political pressure on the Fed to pursue an accommodating policy stance.

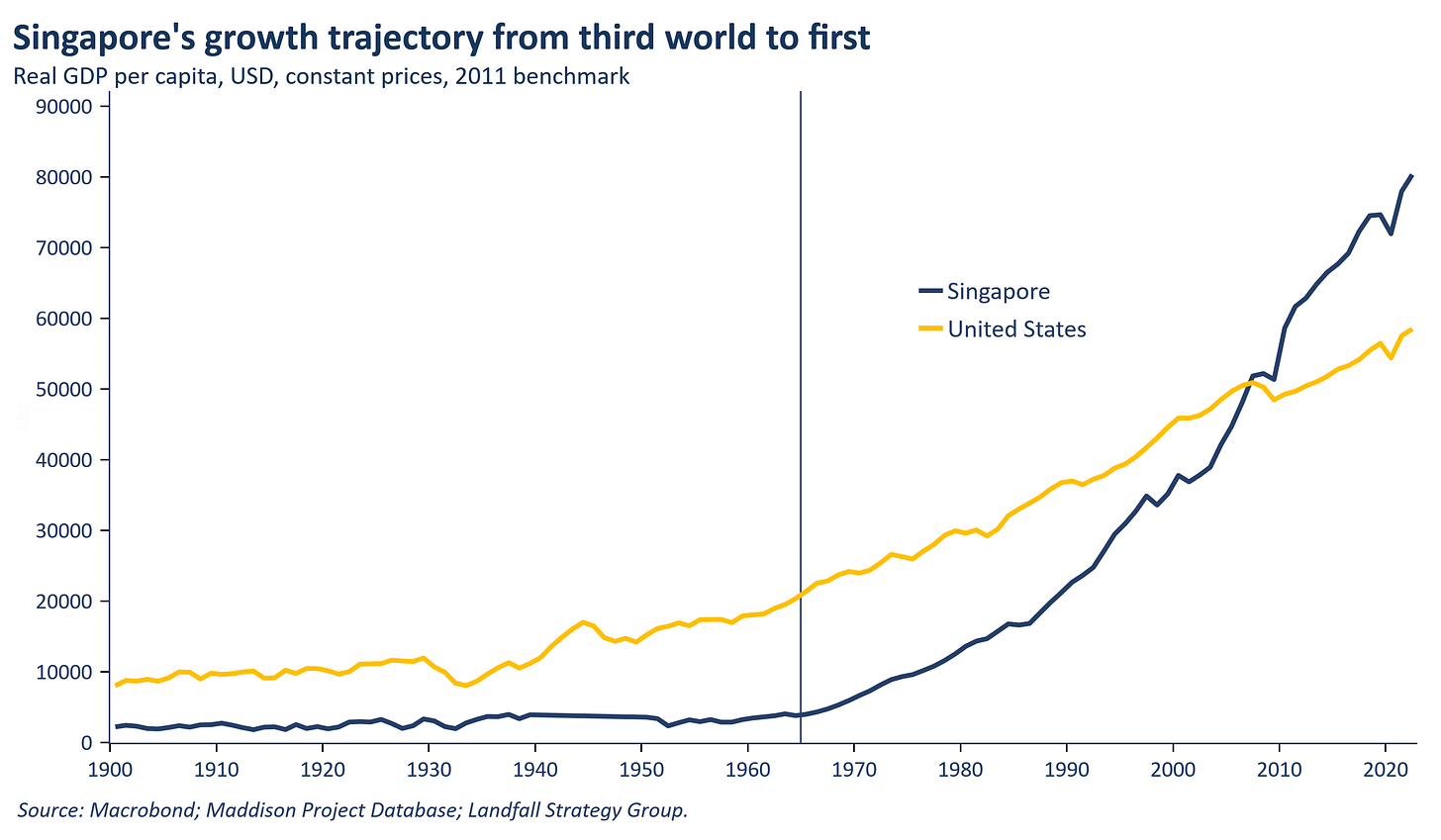

6. Singapore’s 60th birthday

Singapore celebrated its 60th anniversary of independence a few weeks’ ago, a remarkable period of performance. But in addition to the festivities, there was clear recognition of the challenges ahead for Singapore as the open, rules-based global system is weakened. The PM’s National Day Rally speech made these challenges clear. But so far, the Singapore economy is holding up: MTI recently upgraded its GDP growth forecast for 2025 (0-2%) and exports have been relatively resilient. Small advanced economies, notably Singapore, have prospered over the previous several decades not just because of the supportive global environment but because of well-judged policy: it is good management not just good luck. Indeed, PM Wong’s speech emphasised investing in skills and innovation, new growth sectors, and international partnerships in response to the challenges of tariffs and geopolitical rivalry. Although Singapore’s deeply externally-oriented economy is exposed to global shocks, investing at scale to strengthen competitive advantage may more than offset these costs (as has been the case repeatedly for Singapore in the past).

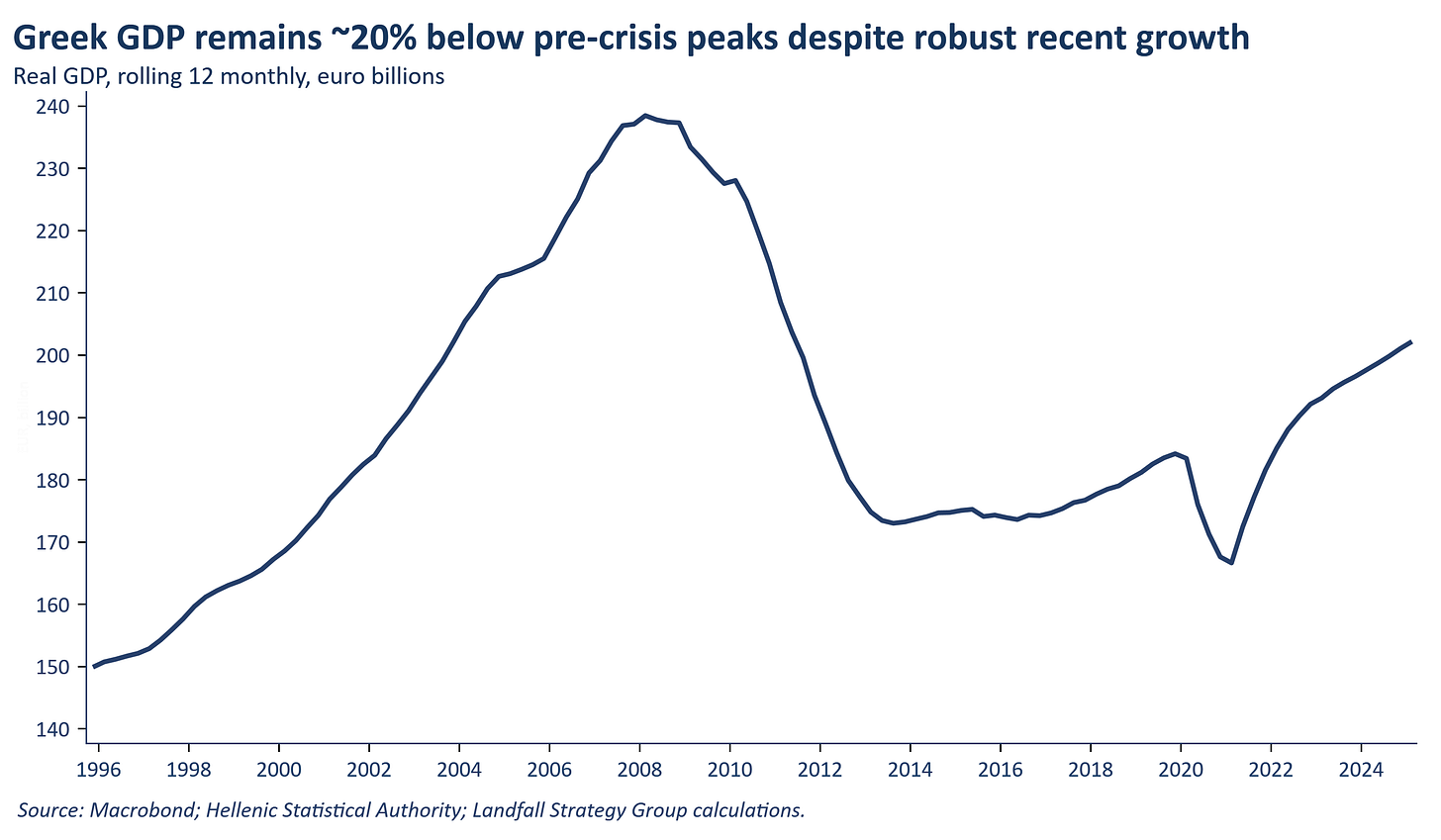

7. Greece

I spent part of the summer break supporting the Greek economy from the beach. It is worth recalling how far Greece has come since the eurozone debt crisis: Greece is one of the fastest growing economies in Europe, has one of the best performing advanced economy equity markets, its public debt has reduced sharply (with further reductions forecast), and interest rate spreads have reduced sharply. However, the scars of the crisis remain evident: Greek real GDP is ~20% lower than in 2008; Greek employment is ~7% lower; and the Greek population is >5% lower than in 2008. And for most, real incomes have not returned to pre-crisis levels. But substantial improvements have occurred; indeed, one of the striking aspects of the Greek tourism economy was the number of foreign workers – from Asia to Africa (and Finland, although the draw was likely the weather…). Much remains to be done, but Greece has consistently exceeded expectations over the past decade.

To receive my free public notes on global economics & geopolitics, subscribe here:

If you liked this note, do forward it - or share it with your network: