Shifting macro risks

A slowing US economy is attracting significant attention; but China poses a more significant risk to the global economy

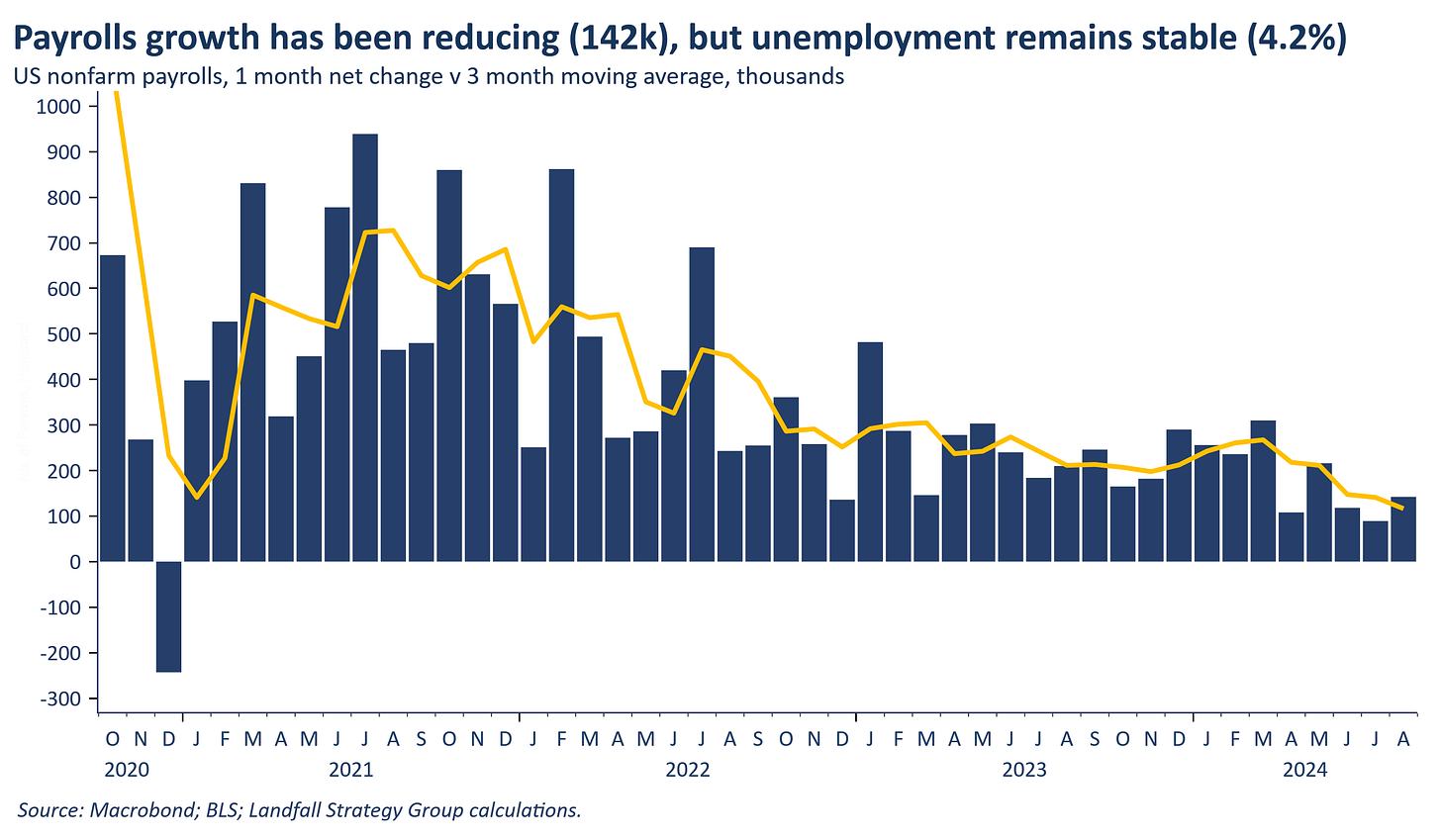

The big economic story of the past two months has related to concerns about heightened risk of US recession. US markets sold off heavily on economic concerns in August; and after recovering their losses, have dropped again over the past week: soft manufacturing PMI data was a catalyst, along with weakening labour market data. The US economy is clearly slowing, and the Fed will begin to cut policy rates at its September meeting.

However, my assessment is that US recession risk is overplayed. The labour market data are not terrible; and other indicators, notably consumer spending, are in decent shape. Households and firms will benefit from lower interest rates; fiscal policy will remain expansionary; capex will become an increasingly important growth driver (the ‘great reindustrialisation’); and US labour productivity data are robust.

The political risk profile in the US has also reduced over the past several weeks, as the likelihood of a Trump victory has reduced: VP Harris is ahe…