Our dollar, your problem

Tight US monetary policy in response to surging inflation is creating issues around the global economy, with potentially lasting economic & political consequences

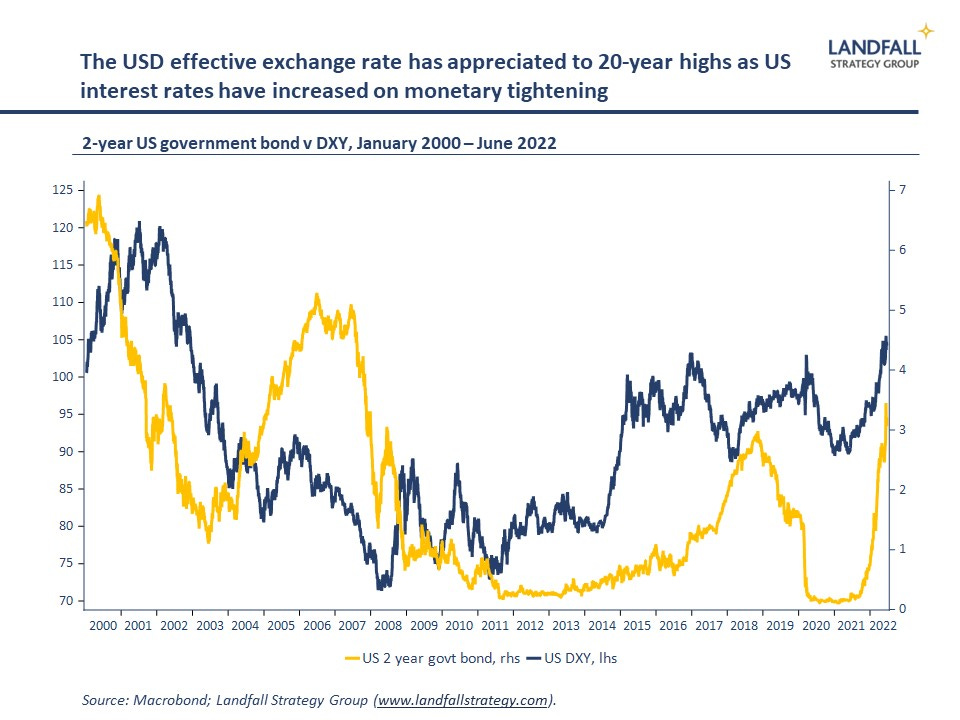

The US Federal Reserve increased policy rates by 75bp last week. Market pricing is for the policy rate to increase to over 3% by the end of the year, up from 0.25% in January. Borrowing rates in the US have increased to reflect this. This is a response to surging inflation in the US, which is due more to excess demand than higher energy prices (see ‘chart of the week’ at the bottom of the note).

Rapidly tightening monetary conditions will have an impact on the US economy. A recession is seen as increasingly likely; and US equity markets have moved into bear market territory over the past few weeks.

The central role of the US in the global financial and economic system means that these monetary policy decisions will also have substantial effects across the global economy. And structurally, these dynamics will intersect with a fragmenting global economic system.

Economic spillovers

Relatively tight US monetary policy is having significant effects on exchange rates around the world. …