Global briefing: The geopolitics of the debt ceiling/ China as peacemaker?/ Financial crisis or credit crunch?/ Weakening Western flows to China/ Sweden

Perspectives on five things that matter this week

1. The geopolitics of the debt ceiling

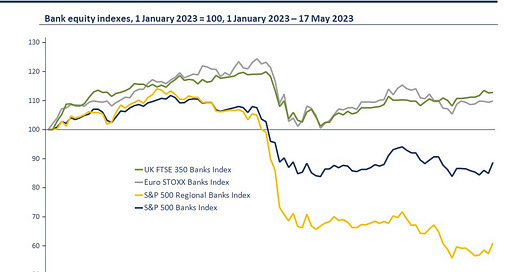

The US debt ceiling drama continues to build, with Janet Yellen’s estimate of ‘x date’ of June 1 looming larger. Markets have been relatively sanguine so far, other than moves in short-dated Treasuries and credit default swaps, assuming that this will play out as previous debt ceiling crises have – with political brinkmanship leading to some near-term economic and financial costs before a (temporary) resolution is reached.

Despite the stream of positive updates from President Biden and Speaker McCarthy on the likelihood of a deal, my assessment remains that the potential for things to go wrong is significantly higher than is priced. This is largely because of the political incentives not to compromise, particularly in the Republican Congress. I put the probability of default (or a near miss) at up to 20%.

A default would generate much more significant economic costs than the 2011 debt ceiling crisis, which led to a downgrade, but no default, before an agreement was reached. Even so, equity markets sold off heavily in the period around these events in 2011 before recovering (the S&P500 was down by as much as 17% over a fortnight) and there was a material hit to GDP.

Combined with the current financial stresses in the US (see discussion below), this could be a major economic and financial event – perhaps pushing the US economy into a recession.

This debt ceiling crisis also has geopolitical consequences. A default (or a near default) would weaken perceptions of US power and its ability to govern itself effectively. Even short of this, the performance politics around the debt ceiling is corrosive of trust in the US.

The global financial crisis was at the centre of China’s reappraisal of the strength of the US – and contributed to China’s strategic shift to more assertive approach under President Xi (‘the east is rising, the west is declining’). A self-inflicted debt ceiling wound would reinforce this assessment in the context of the strategic competition underway. As just one example, President Biden has had to cancel this weekend’s visit to Australia and Papua New Guinea because of ongoing debt ceiling negotiations.

And default – or simply elevated risk – would likely accelerate the gradual erosion of the reserve currency status of the USD. Diversification is already underway for economic and geopolitical reasons, and default would strengthen this process. Although the USD has traditionally gained during debt ceiling crises (on flight to safety motivations), there are now more countervailing forces – including better options than in 2011. And over time there will be less demand for holding USD assets.

Deliberately defaulting in a period of intense strategic competition would do major strategic damage to the US, offsetting the other investments being made to strengthen the US economy. This is another example of what the late US diplomat George Kennan once called ‘the hubris of inordinate scale’; only the reserve currency issuer would be prepared to pull risky stunts like this.

2. China as peacemaker?

China’s special envoy to Ukraine made his first visit to Kyiv on Wednesday and Thursday, and is also visiting Moscow, Warsaw, Berlin, and Paris. This comes after the long-awaited call between Presidents Xi and Zelenskyy a couple of weeks back.