Geopolitical shocks and shifts

Beyond managing exposures to geopolitical shocks, firms, investors, and governments need to position for structural geopolitical shifts

A common view across firms and investors over the past few decades has been that, although geopolitics may be interesting, it does not materially shape profits or returns. Indeed, the market and commercial impact of geopolitical events like 9/11 or the Trump US/China trade wars was often fairly nominal or short-lived.

Over long horizons, geopolitical shocks have been argued to be just another source of noise, along with other transitory economic and policy shocks.

But this perspective is changing, with geopolitics now firmly on the strategic agenda for Boards and CEOs – and a central theme for institutional investors. US/China strategic rivalry is a core part of the functioning of the global economy, affecting trade, investment, and technology flows; and the economic sanctions imposed after Russia’s invasion of Ukraine has had a clear commercial and market impact. And from the Middle East to Taiwan, there are multiple commercially-relevant geopolitical risks on the radar.

From Germany to Japan, and ASML to TSMC, the impact of geopolitical events on firms and economies is increasingly evident. An interesting paper just out finds that the geopolitical exposure of firms has a material, strengthening impact on financial performance. Internationally exposed firms and investors need to treat geopolitical dynamics as a first-order driver of outcomes.

‘You may not be interested in war, but war is interested in you’, Leon Trotsky

Geopolitical shocks

To think about geopolitical exposures in a structured way, I find it useful to distinguish between geopolitical shocks and geopolitical shifts.

Much of the commentary, and organisational response, around geopolitics relates to questions about specific shocks: will the Middle East conflict expand, with a bigger impact on global supply chains and energy prices?; what is the likelihood and impact of an invasion of Taiwan?; what will a second Trump Presidency mean for global flows?

These risks can have meaningful impacts, and the accompanying exposures should be understood and managed. Developing monitoring capabilities around key geopolitical risks is important for firms and investors. Organisations are investing more in understanding geopolitical risks, developing early warning systems, and gaming out scenarios, in order to position appropriately for these risk exposures.

However, predicting specific shocks is difficult: Russia’s 2022 invasion of Ukraine came as a surprise to many observers, as did the Hamas attack on Israel – or 9/11. There are myriad possible geopolitical risks, with probabilities, timings, and impacts that are hard to assess precisely.

‘Events, dear boy, events’, UK PM Harold Macmillan when asked what would shape his government’s course

Given this deep uncertainty, many firms and investors still opt for ex post scrambling in response to an observed shock rather than investing in ex ante risk management and positioning. But the increasing frequency and materiality of geopolitical shocks means that this reactive approach carries risks. After a shock occurs, it may be very costly to adjust: for example, the deep exposure of German firms to Russian gas made adjustment difficult when gas prices spiked. Germany’s recent economic malaise is partly due to a failure by firms and the government to proactively manage these risks.

Geopolitical shifts

In the context of this deep uncertainty, a broader approach to managing geopolitical risks and opportunities is needed. Beyond managing exposures to specific geopolitical shocks, firms, investors, and governments should also be positioning for structural geopolitical shifts.

For the past few decades, post-Cold War geopolitical stability has supported intense globalisation as well as a ‘Washington Consensus’ approach to economic policy. Firms and investors that recognised this regime change, expanding into global markets, did well. Small advanced economies, focused on external markets, generated strong performance.

But we are entering a new geopolitical regime: the global environment will be structurally different than over the past few decades. Organisations need to position for geopolitical regime change (shifts): that is, to form a view on medium-term geopolitical dynamics at work and then position to capture opportunities and manage risks.

Some of the key dimensions of this geopolitical regime change include:

Global economic fragmentation: global trade, investment, and knowledge flows will be shaped by geopolitical alignment, with a preferencing of flows between ‘friends’. This fracturing will be led by sensitive goods, such as semiconductors, but will extend beyond this. Economic sanctions due to geopolitical tensions have included Chinese sanctions on Australian barley and wine, Norwegian salmon, and South Korean tourists. A broad array of markets and categories will be shaped by this weaponisation of international commerce.

Firms and investors will need to compare available returns against the geopolitical risk profile of different locations and commercial partners - and consider this against their organisational risk appetite. Increasing geopolitical risk is already leading firms and investors to make different decisions about allocating capital as well as market entry and exit. FDI into China is sharply down, for example, while flows into India, Vietnam, and Mexico - as well as into the US - are up.

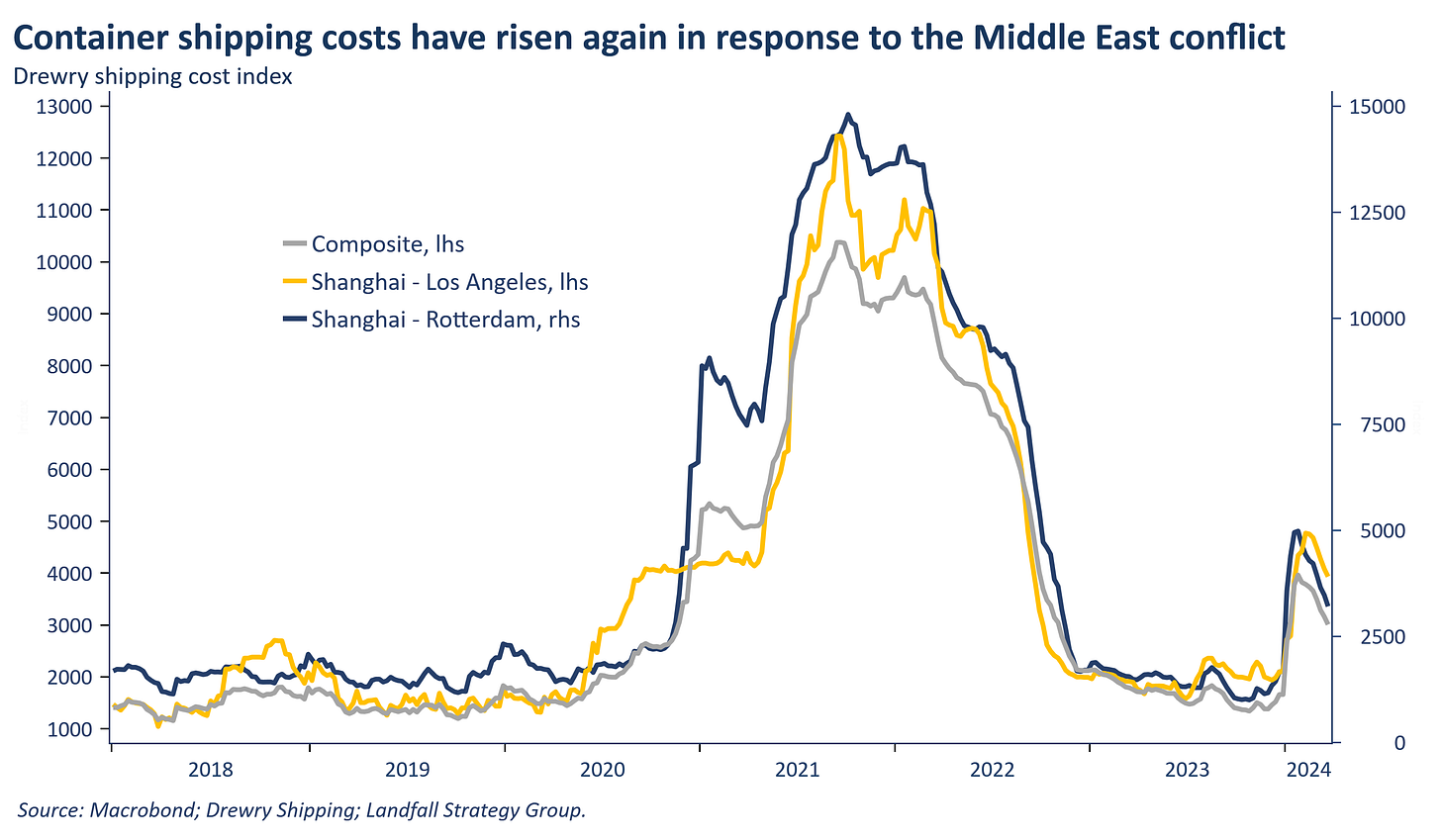

Increased risk profile: Geopolitical rivalry and fluidity mean that there will be an increased frequency of geopolitical tail risk events, which will lead to disruptions in global flows and economic activity. For example, global supply chain disruptions (e.g. the Suez Canal), the imposition of economic and trade sanctions (e.g. on trade with Russia or China), or economic shocks (such as the spike in energy costs in Europe, which has weighed on economic activity). Events like an invasion of Taiwan – which I still assess to be unlikely, although possible – would have an even bigger economic impact.

This is shaping corporate strategy: firms are adjusting supply chain locations, with increased re/near-shoring as well as friend-shoring, to manage geopolitical and other commercial risks (see this ECB survey of European firms). Governments are also acting to increase strategic autonomy in areas from energy and rare earths to semiconductors and pharmaceuticals. And in an environment of higher background risk, more conservative balance sheet positions (less debt) will be an advantage.

Economic policy: The geopolitical environment also shapes economic policy, as discussed in a recent note. Strategic geopolitical competition will lead to more expansive macro policy: expect higher government spending and debt, on increased commitments to military spending, industrial and innovation policy, infrastructure, and so on. This will also be a structurally higher inflation environment, with interest rates that are higher for longer. The period of secular stagnation is over: this will be a higher pressure economy.

Unlike the Cold War, the current version of geopolitical rivalry involves full-spectrum strategic competition – with economic, financial, and technology flows as core domains. Aggressive industrial policy will become a central feature of strategic competition, often supported by elements of protectionism (like the Inflation Reduction Act in the US). This presents both risks and opportunities for firms: increased government support as well as the risk of constrained market access.

Implications

Geopolitical discussions within organisations should be framed broadly around positioning for geopolitical regime change. Monitoring and managing exposures to specific geopolitical risks is important (these are often material exposures), but it is the extent to which firm/investment/economic strategy can adapt to structural geopolitical shifts that will be central to prospering in this new world.

So beyond stepped-up geopolitical risk monitoring, organisations should strengthen strategic capability around the economic and commercial implications of geopolitical dynamics. Big strategic calls will be required as the strategic direction of geopolitical travel continues to shift.

These notes provide a small sample of the insights and advice that we provide to clients. We offer engagement models to support organisations navigate a disruptively changing economic and geopolitical environment. These services include:

§ Quarterly in-depth briefings on critical global economic and geopolitical dynamics

§ Regular calls to discuss the specific implications of global changes, as well as other strategic issues

§ Commissioned project work on strategic issues

§ An institutional subscription for full access to my weekly notes on global developments

Do get in touch with me at david.skilling@landfallstrategy.com for information on these services and options for how we can support you.

If you haven’t already, you can subscribe for free to receive my public notes.

If you liked this note, please hit the like button and also share it with your network:

Previous small world notes are available here:

You can also connect with me on LinkedIn.