China shakes the world

The spillovers from China’s growth model will create stresses across the global economy, with economic and geopolitical implications

The headline from China’s ‘two sessions’ meetings over the past week was the (optimistic) ‘around 5%’ GDP growth target for 2024. But also of significance was the ongoing commitment to ‘high quality growth’, with a focus on industrial sectors and advanced technologies.

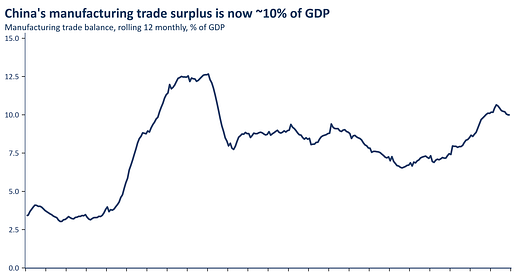

There is an aversion to consumption-driven growth, with little increase in fiscal stimulus or reforms to the social insurance system. Export-oriented industrial growth will be an important contributor to achieving the ~5% GDP growth target. Indeed, there is an ongoing rotation away from the property sector as a driver of growth: bank lending into real estate is declining while increasing into industry.

Relatively weak domestic demand in China (national savings are >40% of GDP), and the sectors in which China is developing positions of strength, mean that export markets are the vent for surplus. China is now the world’s largest car exporter (overtaking Japan last year) and is a major player in renewables (solar, turbi…